Smart Software that simplifies, scales, and succeeds.

Our Software Products.

-

C@TS™

COTS Customs and Taxation System

-

ACT

Workflow Automation and Management Solution

-

RISK

Risk Management Solution

Questions

you might have.

(FAQs)

-

C@TS™ is a Customs and Taxation System that is highly configurable and ready to be implemented as a Commercial-Off-The-Shelf-System (COTS) in revenue administrations around the world. Proven track record in full-country implementations.

-

Key features of COTS software:

Ready-made: It’s a pre-built solution based on specialized knowledge.

Cost-effective: More affordable than custom-built software.

Faster deployment: Can be implemented and used quickly.

Limited customization: While COTS software can often be configured, deep customization is usually limited.

Widely supported: Vendors offer ongoing support, updates, and patches.

-

C@TS™ ACT (Application Configuration Tool), wedoIT’s in-house built Workflow Management Software, is available as a stand-alone solution or as a fully integrated module of C@TS™, offering multi-language support.

-

C@TS™ RISK Management (Risk Identification, Strategy and Knowledgebase), a fully integrated module of C@TS™ or a stand-alone solution, incorporates a reliable, industry-standard engine to provide the heart for the execution of compliance calculation.

-

Yes, please refer to our Services page.

Our offered Software Products reflect +15 years of experience working as a Software Development and Consulting Company, thereby offering you the benefits of proven best practices and track-records. Please feel free to browse our Software Products information and do not hesitate to schedule a session with our team should you have further questions or wonder how we can best support your specific or unique features.

C@TS™ - Customs and Taxation System.

Designed for maximum configurability, our solution is ready to be deployed as a Commercial-Off-The-Shelf (COTS) system in revenue administrations globally.

Why C@TS™?

Complete eTaxation software solution - Core System and Taxpayer Portal.

Fully integrated system for all tax types with seamless data utilization and configuration.

Taxpayer 360 view across all tax types and all modules.

Accounting across all tax types, including reconciliation and automatic enforcement actions.

Payment reception and processing, including suspense account management, balance transfer and refunds across all tax types.

Integrated Document Management for paperless operations, including the documents generation and storage of imported documents.

Case Management with the integrated Workflow Manager and Forms Designer across the core system and the taxpayer portal.

Highly configurable reference data.

Fully integrated reporting mechanisms based on system data or external data.

Automatic execution of server processes based on scheduled times and specific parameters.

Tax Administration 3.0

C@TS™ provides a ready-to-use system for Tax Administration 3.0, featuring two main components: a customizable integration layer and a real-time, advanced analytics risk management system.

Technical Facts.

Development and run-time environment using proven Microsoft technologies.

Know-how widely available due to the usage of Microsoft development tools.

Same technology stack for core tax system and taxpayer portal (C@TS™ Taxpayer Portal).

True multi-language support for the user interface, reference data & reports & generated documents.

Support for multiple data base providers.

Various supported communication channels for 3rd party services

Support for Micro Service Architecture (MSA).

Single point for user, user groups, user roles and permissions management.

Support for cloud, on-premises or hybrid run-time environments.

C@TS™ Taxation - Core System and Taxpayer Portal

C@TS™ System operates an integrated notification system that enables communication between the Core System and the Taxpayer Portal. Both Core System and Taxpayer Portal can be accessed with respective user credentials from various browsers and offer integration with electronic authorization providers. User interfaces are designed in a way to enable seamless in-context navigation between different functionalities and to provide the same look and feel.

C@TS™ Key Functions & Modules.

-

The Core System offers electronic services to tax officials and authorized users, including, but not limited to:

Tax Officer Dashboard

Registration and Taxpayer Management

Return Sheets (Tax Declarations) & Assessments

Tax Invoices, Withholding Slips

Accounting and Payment Processing

Audit

Debt Management, Enforcement and Collection

Objections & Appeal

Case and Workflow Management

Reference Data

Reporting

Server Processes

User and Access Management

RISK Management

FAQs

-

The Taxpayer portal offers electronic services to taxpayers and their representatives, including, but not limited to:

Taxpayer Dashboard

My Portal (Taxpayer Profile)

Submission of Return Sheets (Tax Declarations)

My Accounting - calculation of real-time liabilities

Payments (Payment Order / Billing Code)

Case Management (Taxpayer Services)

Submission of Sales & Purchase Books

Simple Record of Bookkeeping, Tax Invoice, Withholding Slips

Access and Representatives Management

C@TS™ for Customs.

Given the unique specifications and requirements of national Customs Administrations in each country, C@TS™ offers a versatile platform and essential components to initiate and support customized implementations tailored to the needs of each administration.

ACT - Application Configuration Tool.

C@TS™ ACT, wedoIT’s in-house built Workflow Management Software, is available as a stand-alone solution or as a fully integrated module of C@TS™, offering multi-language support.

ACT Workflow and Case Management.

Visual drag and drop business workflow designer.

Case management based on business workflows.

Manual and automatic trigger-based case creation.

Role based access control within cases.

Workflow timers and process performance metrics.

Fully customizable workflow steps.

Integration with existing systems.

ACT Forms Designer.

Visual forms designer.

Full configuration on the form field level.

Pre-defined form components with the capability of developing additional components for easier reuse.

Dynamic forms with configurable field visibility condition based on user input.

Validation rules and calculation rules.

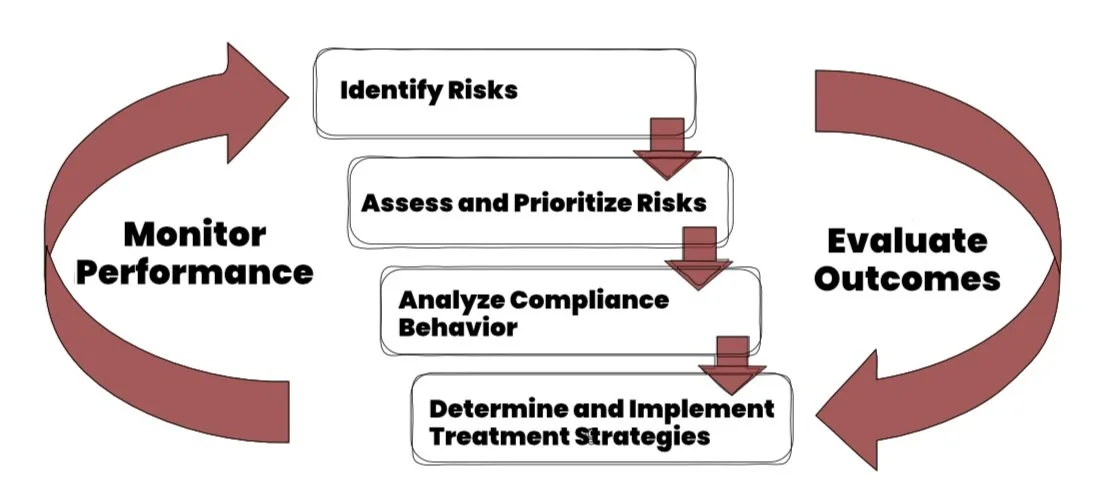

RISK Management.

C@TS™ RISK Management (Risk Identification, Strategy and Knowledgebase), a fully integrated module of C@TS™ or a stand-alone solution, incorporates a reliable, industry-standard engine to provide the heart for the execution of compliance calculation.

Risk Register - configurable and comprehensive

Risks, Risk Rules, Risk Rule Sets definition

Treatment Options for different risks

Other necessary attributes for granular and precise output of the risk management process

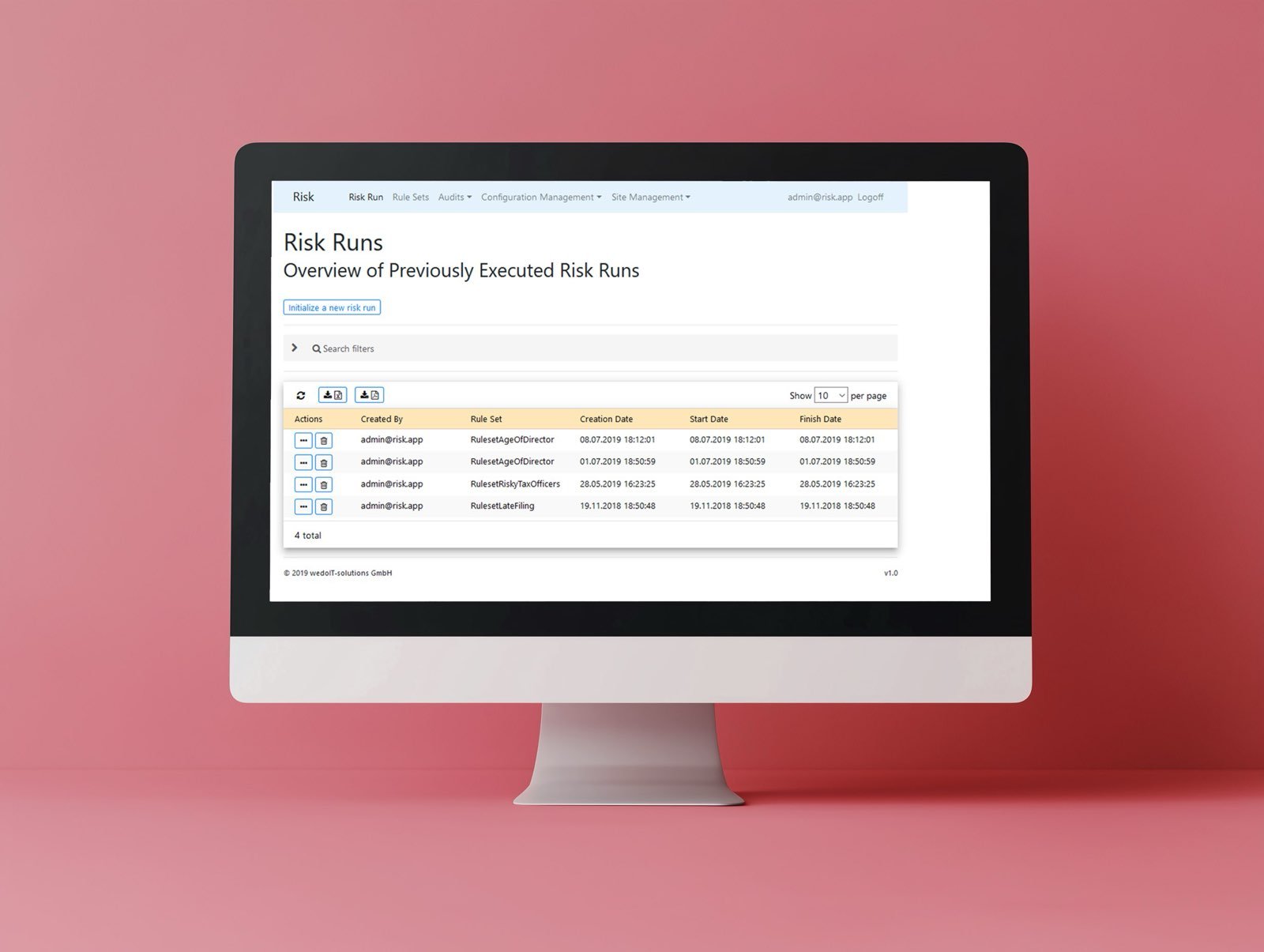

Risk Engine - reliable and flexible

Risk rules execution

Support for automatic and manual execution

Risk Results - analytical and visual

Risk scores per taxpayer

Integrated risk level in the taxpayer profile

Risk reports and dashboard, based on the organizational needs.

RISK supports two modes of operation

On-demand risk assessment

Continues risk assessment, based on predefined triggers in the system

"Efficiency is doing things right; effectiveness is doing the right things."

- Peter Drucker, Austrian American Management Consultant, Educator, and Author